After 18 Years, Ctrip Will Be Listed Again

Strange to say, it's like reincarnation, or fate.

After SARS in 2003, Ctrip was listed on NASDAQ. After the COVID-19 epidemic in 2021, Ctrip was listed again on Hong Kong Stock Exchange. On April 19, Ctrip Group was officially listed on the Stock Exchange of Hong Kong, with the stock code 9961. HK, becoming the first online tourism enterprise to be listed in two places.

Returning to the Hong Kong capital market after 18 years, Sun Jie, CEO of Ctrip, said that in a comprehensive analysis of the global GDP trend and prediction, China will be far ahead in the future, and Asia will be far ahead compared with Europe and the United States. Therefore, returning to Asia for secondary listing at this time will certainly play a very important role in promoting the development of Ctrip in the next 5-10 years.

"The difference is that after more than 20 years of development, Ctrip has become a global enterprise with tens of thousands of employees, and our competitors are no longer domestic, but global competitors." Liang Jianzhang, chairman of the board of directors of Ctrip Group, said that as an international company, Ctrip will continue to improve its global competitiveness after the end of the epidemic.

However, "this time's challenge is not necessarily smaller than that of the year." Jiang Qikang, the former Secretary General of the China Tourism Association, believes that the epidemic is much more serious than that of 2003. It is difficult for international tourism to recover to the pre epidemic level within two or three years. If only domestic competition, the internal volume will intensify, and the challenge to Ctrip will be even greater.

Catch the "May Day" Tourism Hotspot

At 9:30 on April 19, Ctrip Group held a listing ceremony at the Hong Kong Stock Exchange in its headquarters in Shanghai, and its app also launched the "online cloud gong" activity, allowing its employees and global users to watch the whole listing process together.

After the opening of the market, Ctrip's share price rose by nearly 5%. As of the closing, Ctrip closed at 280 Hong Kong dollars, up 4.55%, with a market value of about 177.2 billion Hong Kong dollars. On the same day, Ctrip US shares closed at US $36.51, with a market value of US $21.945 billion, or about HK $170.4 billion.

The final selling price of Ctrip's international offering and Hong Kong public offering back to Hong Kong was locked at HK $268.00 per share, and a total of 31635600 ordinary shares were issued. If other factors are not included, the net amount raised by Ctrip's secondary listing in Hong Kong will be at least HK $8.3 billion. The company said that it planned to use the net amount of funds raised from the global sales to fund the expansion of one-stop tourism products, improve user experience, invest in technology to enhance its leading market position in products and services, improve operational efficiency and meet the needs of general corporate purposes and working capital.

There were also many tourism stocks that rose with Ctrip's share price that day. Tongcheng Yilong, another tourism OTA company in Hong Kong, rose 6.5% to close at HK $20, with a market value of HK $43.86 billion. The A-share market is more lively. Guilin tourism, Zhangjiajie and other scenic spots are up and down, and Tibet tourism, Zhongxin tourism and Xi'an tourism are also up more than 5%.

The main reason for the carnival of many tourism stocks is that the upcoming "May Day" Golden Week travel and tourism market are extremely hot. It is expected that the number of tourists will exceed 200 million. The phenomenon of "one ticket is hard to find" reappears in train tickets. The prices of air tickets and hotels have increased significantly compared with those in 2020 and before the epidemic, showing a situation of "both quantity and price rise".

According to Ctrip's 2020 financial report, under the influence of the epidemic, the revenue of the four major business segments of Ctrip, including accommodation booking, transportation ticketing, tourism and vacation, and business travel management, has declined. The annual revenue totaled 18.327 billion yuan, with a loss of 3.269 billion yuan, down 49% and 147% year on year respectively.

Jiang Qikang believed that the whole capital market was not optimistic about the tourism industry because of the long duration of the epidemic, the repeated outbreaks abroad until now, and the failure to recover international travel. Although Ctrip has made great efforts, its international business accounts for a large proportion and has been greatly affected.

At present, the overseas tourism market can not be done, and tourism enterprises can only focus on the domestic market. The competition in the domestic market is very cruel. "Ctrip is not challenged by other old online OTAs, but by new competitors such as Meituan, Xiaohongshu, Diaoyin, etc." Jiang Qikang pointed out that these APPs have huge traffic and high transaction frequency. Although they are not dedicated to tourism, the current tourism business is growing rapidly, while Ctrip The opening rate of traditional APPs such as Tuniu is much lower. After all, tourism is not a high-frequency consumption. Therefore, Meituan playing Ctrip is a bit of high-frequency and low-frequency.

This competition has also led to some controversy and discussion in the industry: "Is it better to be specialized or to be broad?" Jiang Qikang pointed out that the crisis of Ctrip at this time is no less than that when it was listed in 2003. All business lines are facing considerable challenges.

Responding to disputes

In fact, before the listing of Ctrip, the question about whether the 22-year-old Ctrip can still eat has never stopped in the market.

As Jiang Qikang pointed out, Ctrip's rivals in the new era are no longer traditional OTAs, but large traffic groups, small red books and dithering. In 2020, the revenue of Meituan to stores, hotels and tourism will be 21.25 billion yuan, which has exceeded the annual total revenue of Ctrip. In addition, according to Trustdata, in 2019, the number of nights between Meituan hotels continued to exceed the total number of Ctrip hotels, and Q4 even widened the gap to 1.22 times.

Therefore, in 2020, Ctrip began to transform from a trading platform to a marketing trading platform. Ctrip hopes that the content marketing ecology represented by live broadcast, community and Planet will break the bottleneck of Ctrip's traffic growth while activating users' travel inspiration, and provide new value drivers for transaction transformation, supply chain empowerment, etc. "Customers are very eager to find something on Ctrip, find inspiration, and provide one-stop service immediately." Sun Jie said, so Ctrip continues to expand its segment. At present, the data looks very good. "The time spent on finding inspiration and content from customers doubled, so we are very optimistic about this piece."

Liang Jianzhang's multi role live broadcast of breaking through the image of senior executives of listed companies, as well as numerous transformation attempts on the platform, made people sincerely admire Ctrip's endogenous power, and Ctrip also showed its confidence in its prospectus.

For example, Ctrip's high net worth user group has always been one of the barriers that Ctrip is proud of. According to the prospectus, from 2014 to 2019, the annual compound growth of consumer users with annual expenditure of more than 5000 yuan reached 29%. These high net worth people are also young. According to the data of Yiguan Qianfan, the proportion of people with medium and above consumption level on Ctrip platform is 82.2%, and the proportion of people after 95-80 is 77.7%.

According to the prospectus, in 2020, more than 40% of new transaction users on Ctrip's platform will come from third tier cities and below. The accelerated growth of new users in low tier cities is in line with Ctrip's long-term strategic plan and will also bring new growth points for Ctrip's performance. Since the third quarter of 2020, domestic short distance travel and local travel have become the key driving force for Ctrip's performance recovery. According to the prospectus, in the fourth quarter of 2020, the GMV of hotels in Ctrip Province increased by more than 20% year on year, and the ticket booking volume of scenic spots increased by more than 100% compared with the same period in 2019. In addition, by the end of 2020, the number of local entertainment suppliers had increased by more than 25% year on year.

On the supply side, as of December 31, 2020, Ctrip and 1.2 million accommodation partners around the world have provided a full range of accommodation products covering hotels, resorts, residences, apartments, home stays, guest houses, etc; Cooperate with more than 480 airlines to provide users with ticket products covering more than 2600 airports in more than 200 countries and regions. It provides more than 310000 local entertainment products in destinations worldwide, and has more than 30000 partners in other ecosystems.

It can be said that Ctrip has the strongest and widest supply of upstream and downstream tourism resources in China, which can provide multi-level services to tourists, so it can also build a service competition barrier.

Jiang Qikang believes that Liang Jianzhang, the captain of the fire brigade, saved the fire well. Before the epidemic, Ctrip's market layout was not limited to China, but developed internationally. It can be said that Liang Jianzhang's layout in the international market is very insightful. If it were not for the epidemic, Ctrip might become another Ctrip. But unfortunately, the epidemic has come, and international tourism has not recovered to the level before the epidemic in two or three years. "If Ctrip is limited to domestic development, it will be difficult, and the content transformation is very difficult." Another industry expert who did not want to be named said.

Can Ctrip reproduce the glory of its first listing? Maybe it will take time to solve.

- Related reading

From Inventing Flash Memory To Having Only One Seedling, What Has Japanese Storage Companies Experienced?

|

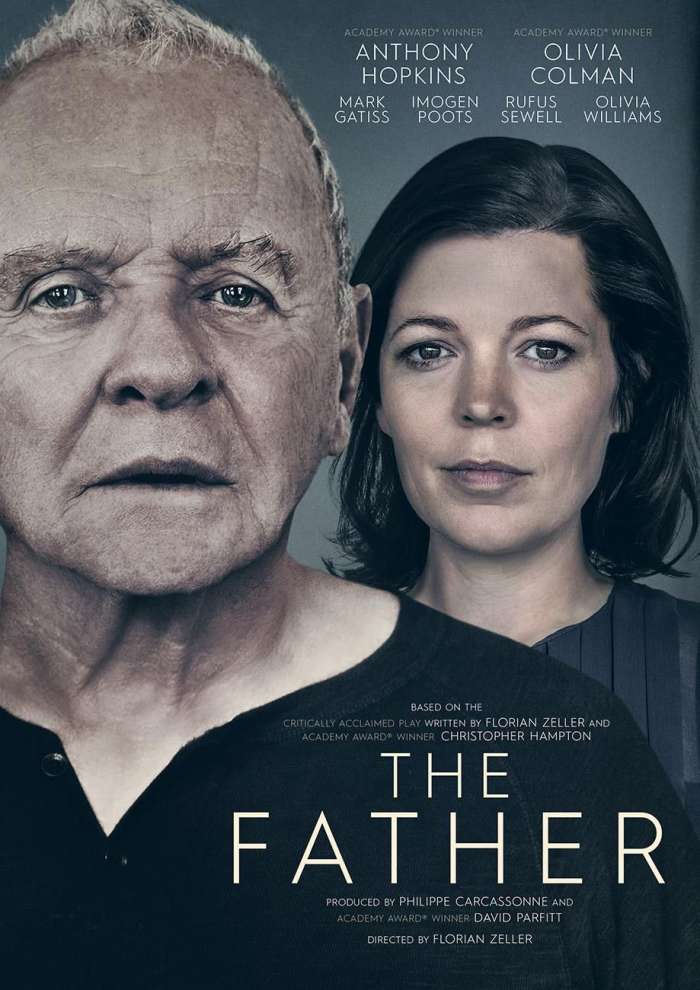

Father Trapped In Time: Seeing The World From The Perspective Of Alzheimer'S Disease Patients

|- Business management | Xia Lingmin, Secretary General Of China Textile Industry Federation, And His Delegation Went To Fujian For Research

- Efficiency manual | Yarn Weaving Industry Cluster In Qiyang, Hunan Province To Create A "Textile Town"

- Contract template | With The Trend Of Synergy, Shengze Has Made Joint Efforts To Enter The "Another Spring" Of Private Economy

- Successful case | From A Campus White T-Shirt To An Annual Sales Of 2.5 Billion Yuan, To Win The Battle Of "Quality Price Ratio" Of Clothing

- Management strategy | 2025 Release Of China'S Leading Apparel Brand -- Leading The Industry In Technological Change And Ecological Innovation

- Shoes and clothing technology | General Technology And New Materials Lead A New Chapter In Textile Technology With New Quality Productivity

- Bullshit | Shenzhen Exhibition, The Source Of New Ecology Of Fashion Sports Energized By Innovative Fibers

- Design Frontiers | The 30Th FASHION SOURCE Shenzhen Exhibition And AW25 Shenzhen Original Fashion Week Were Successfully Closed

- Design Frontiers | "Jiang Fu Day" Will End In 2025 China International Fashion Week (Spring)

- Commercial treasure | SORONA ® Shanghai Fashion Week And Its Partners Build A Symbiotic Ecology

- The Third Largest Steel Enterprise In The World?

- Shanghai Rural Commercial Bank Draws Financial Water To Develop "Oasis"

- Qiu Xiandong: FAW Will Continue To Work Hand In Hand With Audi To Create "Audi Golden Decade"

- Qiu Xiandong: FAW Will Continue To Work Hand In Hand With Audi To Create "Audi Golden Decade"

- 2021 The 7Th Wuhan International E-Commerce And "Internet +" Industry Expo

- Nantong International High End Textile Industry Expo Invites The Whole World

- Mayor Ruijin Investigates 9 Textile And Garment Enterprises

- Advantages Of China'S Textile Industry Development Under Globalization

- Enjoy The New Co Branded Collection Of Supreme X South2wester8

- "Report On The 14Th Five Year Plan" Of Guangdong Garment Industry Released